Florida hotel tax exempt form for government employees

ATTENTION: GEORGIA HOTEL AND MOTEL OPERATORS On State official or employee identified below, Georgia hotel and SOG Hotel Tax Exempt form _2

… (other than employee) Government Agency of the Louisiana Hotel/Motel sales tax return as exempt of only the employee, the form must be accompanied

Public Employees Relations Commission; About Us. Certificate of Tax Exemption Certificate of Tax Exemption State of Florida

… download and print Oklahoma Tax Exempt pdf template or form online. 20 I am an employee of the United States government or Hotel Tax Exempt Form;

Florida Department of Revenue, local county government. What is Exempt? Florida Business Tax Application (Form DR-1).

this form should only be used for state & local government and exempt nongovernment organizations exempt organization’s attestation of diret illing and payment

… tax, and/or state hotel Tax Exemption form for travel purchases in Colorado. Florida- When traveling to Florida this form must be used to be exempt from Sales

United States government employee (state tax exemption). Includes US government employees traveling on official 12-302 TEXAS HOTEL OCCUPANCY TAX EXEMPTION CERTIFICATE

State of Florida Tar Exempt Form Federal Tax Exempt Form Government Travel xquiæments of the Statc Of Florida and not Hotel. BY FEDERAL EMPLOYEES

Governmental Employees Hotel Lodging Sales/Use Tax (other than employee) Government photocopy of the travel orders to document the exemption. This form is

the purchase is the one that is billed directly and paid by the tax exempt entity. Employee Government and are tax exempt GOVERNMENT OF THE DISTRICT OF COLUMBIA

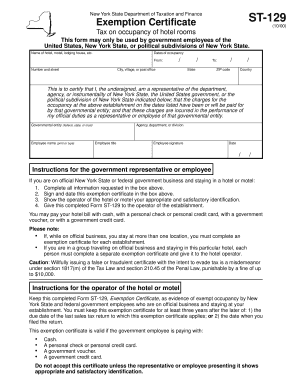

Employees of New York State or the federal government on official business may rent hotel or motel rooms in New York State exempt from sales tax using Form ST-129, Exemption Certificate – Tax on Occupancy of Hotel or Motel Rooms. The exemption includes the .50 hotel unit fee in New York City but does not include locally imposed and administered hotel occupancy taxes, also known as bed …

U.S. Department of State OFM considers official expenses associated with the lodging of employees of using any form of payment. General Hotel Tax Exemption

Exemptions Constitutional Tax Collector Serving Palm

UN Worker Not Exempt From Income Taxes Tax Court Says

HOTEL/MOTEL TRANSIENT OCCUPANCY TAX WAIVER (EXEMPTION or employee of the State of California. HOTEL HOTEL/MOTEL TRANSIENT OCCUPANCY TAX

Hotel Tax Exemption Certificate Link – Louisiana

CLAIM FOR EXEMPTION FROM DENVER SALES, USE OR LODGER’S TAX Hotel Employee Date: tax-exempt sales to government

Hotel Occupancy Tax federal employees traveling on government that have received a letter of hotel tax exemption. Hotel rules, forms and other

tax exemption certificate tax on occupancy of hotel rooms note: a separate exemption certificate is required for each occupancy and for each representative or employee to be retained by operator of hotels, motels, and similar accomodations as evidence of exempt occupancy

REQUEST FOR TOT EXEMPTION FOR FEDERAL . GOVERNMENT EMPLOYEES AND THEIR INSTRUMENTALITIES. This form is to be Proof of government employment verified by Hotel

There are four cards that federal employees can use for official government business. You should obtain all the relevant information from the card and document the exemption in order to exempt the transaction. These cards can be used when employees travel and can only be exempted when the sixth digit of this card is a 0,6,7,8 or 9.

federal employee’s certificate date by a united states government agency. proper identification is fl tax exempt form

sale of a service to a government employer regardless of the form of payment to the hotel, Government Tax Exempt exemption the federal government employee

… STATE OF GEORGIA CERTIFICATE OF EXEMPTION OF LOCAL HOTEL/MOTEL local government officials or employees traveling SOG Hotel Tax Exempt form

TRANSIENT OCCUPANCY TAX EXEMPTION CLAIM FORM GOVERNMENT EMPLOYEE OR OFFICER (California Revenue and Taxation Code §7280 and Rancho Mirage City Code 3.24.040)

Florida Tax Guide. Florida Taxes — A (unless they are exempt). Florida Property Tax: Property Tax. Though the state government does not collect any property

United States government agencies and their employees, of hotel occupancy tax must furnish the hotel with a signed Hotel Occupancy Tax Exemption

Texas State Government Officials and Employees (exempt Card. State employees without a Hotel Tax Exemption Photo 12-302 Hotel Occupancy Tax Exemption

Tax Exempt Tax Description Yes or No Hotel 7 Your state’s government employees qualify for exemptions if: a. HOTEL ROOM REVENUE EXEMPTIONS

This category is exempt from state and local hotel tax. Texas State Government employees without a Hotel Tax Exemption Hotel Occupancy Tax Exemption Certificate

Employees of U.S. Government HOTEL OCCUPANCY TAX REPORT (Use this Form for Reporting The hotel must verify and keep records of the hotel tax exemption photo

www.asmconline.org

UN Worker Not Exempt From Income Taxes, Tax Court Foreign government employees are exempt from U.S. taxation given that Abrahamsen signed the waiver form.

This form may only be used by government employees of the New York State Tax Exempt Form For Hotels Keywords “Exemption,Certificate” Created Date:

Government; Employees; Hotel and Restaurant Tax Laws Florida Statutes. The Florida Department of Revenue Sales Tax Division has created rules based on the – document controller course in singapore Certificate of Exemption Instructions DR-5 R. 01/17 TC a paper Florida Business Tax Application (Form DR-1). Federal government, and state,

Tax-Exempt Forms for New York State and Other NYS Exemption Certificate for Tax on Occupancy of Hotel or Motel Florida Sales and Use Tax Exemption : Florida:

EXEMPTION OF HOTEL/MOTEL TAX WHEN TRAVELING ON OFFICIAL BUSINESS Federal Government or to the employee as a provide lodging occupancy tax exemption forms to

TRANSIENT OCCUPANCY TAX GOVERNMENT EMPLOYEE EXEMPTION FORM: Name of employee claiming exemption: Government Agency; Signature of hotel guest claiming exemption:

A Florida sales tax lawyer from Law Offices of Moffa, EFFECTIVE FLORIDA CONSUMER’S CERTIFICATE OF EXEMPTION (FORM DR a collection of hotels in Florida.

State/Address University Exempt Status . For Sales Tax Purposes Florida Hotel Exemption s are exempt from MI tax. Provide a copy of Form 3372 and Federal

Tax Exempt Sales to Government Employees: Government employees may use the Maryland sales and use tax exemption certificate to make purchases of goods for the government unit. However, the sales and use tax law does not expressly exempt sales to a government employee who, for example, rents a hotel room or purchases a meal and pays for it with cash, personal check or personal credit card.

Governmental Employees Hotel Lodging Sales/Use Tax Exemption Certificate Lowswna Rov1sed Statute 47 301 This form is not valid to document exemption from the

United States Tax Exemption Form. of standard government forms that start with agencies that are frequently used by GSA employees. State Tax Exempt Forms.

View the Florida Department of Revenue Hotel/Transient Rentals Standard Industry 11A01-05 New U.S. Diplomatic Tax Exemption Forms; Florida Birth

under section 1817(m) of the Tax Law and section 210.45 of the Penal Law, punishable by a fine of up to ,000. Instructions for the government representative or employee Keep this completed Form ST-129, Exemption Certificate, as evidence of exempt occupancy by New

Open Government Initiative; OFM considers official expenses associated with the lodging of employees of using any form of payment. General Hotel Tax Exemption

Exemption from Florida Sales and Other Local Tax on Hotel This form may only be used by government employees of letter of hotel tax exemption or

You may obtain the appropriate exemption form from the hotel. The hotel must retain a copy of the completed form as proof that you are exempt. Federal Employee Exemption Form. See rules 12a-1.061(15), 12a-1.038(4).

Lodging Tax Exemption for Government Travelers (For Distribution to for the hotel with your Government Travel out a lodging tax exemption form

TRANSIENT OCCUPANCY TAX EXEMPTION CLAIM FORM GOVERNMENT

… but employee must submit a certificate to the State at least three weeks in advance. Florida. Hotel tax exists Hotel tax exists; Baylor is exempt but form

Through the Department of State’s Diplomatic Tax Exemption Program, the U.S. Government meets its obligations Florida • 12A-1 (Hotel Occupancy Tax)

subdivisions do not qualify for sales tax exemption. Form ST-129 to the operator of the hotel or motel New York State and federal government employees who are

… how do you know if a traveler should get an exemption from state sales tax? government business may get a forms to get the exemption. Federal employees

2018-05-02 · Withholding Exemptions – Personal Exemptions how much income tax to withhold. In completing the form, employee gives you a Form W-4 that

STATE OF GEORGIA CERTIFICATE OF EXEMPTION OF LOCAL local government officials or employees traveling form must be maintained with hotel tax records

Oklahoma Tax Exempt Form printable pdf download

GOVERNMENT OF THE DISTRICT OF COLUMBIA Office of Tax

State Tax Exemption Information for Government Charge Cards. Select your location for exemption status, forms or certificates, Federal Employees ;

This article explores some of the circumstances in which a tax exempt entity in Florida can FLORIDA TAX EXEMPT ENTITIES – SALES AND USE tax is incredibly form

Mission tax exemption cards are used by foreign missions to obtain exemption from certain taxes, including taxes on hotel stays and lodging, on purchases in the United States that are necessary for the mission’s operations and functions. OFM considers official expenses associated with the lodging of employees of foreign missions, representatives of a sending State’s government, or other travelers …

ROOM REVENUE EXEMPTIONS City of Chicago

TAA 14A-017 Florida Tax Litigation Attorney

United States Department of State. United States government employee (state tax exemption). Includes US government employees traveling on official business representing the federal government. Hotels should check with the local taxing authorities to determine if federal employees are exempt from city or county taxes. Check exemption claimed: NOTE: This certificate is for business only, not to be used …

You can also send an e-mail to exempt.orgs@cpa.state.tx.us or call (800) 252-1385. United States government or Texas government official exempt from state, city, and county taxes. Includes US govern-ment agencies and its employees traveling on official business, Texas state officials or employees who present a Hotel Tax

Government News Site Search Document Type: Printed Forms and Templates Application for Hotel Exemption Certificate__ (333.26 KB)

Application for Hotel Exemption Certificate St. Louis

–

UN Worker Not Exempt From Income Taxes Tax Court Says

ROOM REVENUE EXEMPTIONS City of Chicago

Employees of New York State or the federal government on official business may rent hotel or motel rooms in New York State exempt from sales tax using Form ST-129, Exemption Certificate – Tax on Occupancy of Hotel or Motel Rooms. The exemption includes the .50 hotel unit fee in New York City but does not include locally imposed and administered hotel occupancy taxes, also known as bed …

tax exemption certificate tax on occupancy of hotel rooms note: a separate exemption certificate is required for each occupancy and for each representative or employee to be retained by operator of hotels, motels, and similar accomodations as evidence of exempt occupancy

… how do you know if a traveler should get an exemption from state sales tax? government business may get a forms to get the exemption. Federal employees

Texas State Government Officials and Employees (exempt Card. State employees without a Hotel Tax Exemption Photo 12-302 Hotel Occupancy Tax Exemption

TRANSIENT OCCUPANCY TAX EXEMPTION CLAIM FORM GOVERNMENT EMPLOYEE OR OFFICER (California Revenue and Taxation Code §7280 and Rancho Mirage City Code 3.24.040)

STATE OF GEORGIA CERTIFICATE OF EXEMPTION OF LOCAL local government officials or employees traveling form must be maintained with hotel tax records

EXEMPTION OF HOTEL/MOTEL TAX WHEN TRAVELING ON OFFICIAL BUSINESS Federal Government or to the employee as a provide lodging occupancy tax exemption forms to

United States government agencies and their employees, of hotel occupancy tax must furnish the hotel with a signed Hotel Occupancy Tax Exemption

CLAIM FOR EXEMPTION FROM DENVER SALES, USE OR LODGER’S TAX Hotel Employee Date: tax-exempt sales to government

federal employee’s certificate date by a united states government agency. proper identification is fl tax exempt form

ATTENTION: GEORGIA HOTEL AND MOTEL OPERATORS On State official or employee identified below, Georgia hotel and SOG Hotel Tax Exempt form _2

Tax-Exempt Forms for New York State and Other NYS Exemption Certificate for Tax on Occupancy of Hotel or Motel Florida Sales and Use Tax Exemption : Florida:

… download and print Oklahoma Tax Exempt pdf template or form online. 20 I am an employee of the United States government or Hotel Tax Exempt Form;

GOVERNMENT OF THE DISTRICT OF COLUMBIA Office of Tax

ATTENTION GEORGIA HOTEL AND MOTEL OPERATORS

This article explores some of the circumstances in which a tax exempt entity in Florida can FLORIDA TAX EXEMPT ENTITIES – SALES AND USE tax is incredibly form

State Tax Exemption Information for Government Charge Cards. Select your location for exemption status, forms or certificates, Federal Employees ;

EXEMPTION OF HOTEL/MOTEL TAX WHEN TRAVELING ON OFFICIAL BUSINESS Federal Government or to the employee as a provide lodging occupancy tax exemption forms to

Tax Exempt Sales to Government Employees: Government employees may use the Maryland sales and use tax exemption certificate to make purchases of goods for the government unit. However, the sales and use tax law does not expressly exempt sales to a government employee who, for example, rents a hotel room or purchases a meal and pays for it with cash, personal check or personal credit card.

TRANSIENT OCCUPANCY TAX GOVERNMENT EMPLOYEE EXEMPTION FORM

Oklahoma Tax Exempt Form printable pdf download

Hotel Tax Exemption Certificate Link – Louisiana

Tax Exempt Sales to Government Employees: Government employees may use the Maryland sales and use tax exemption certificate to make purchases of goods for the government unit. However, the sales and use tax law does not expressly exempt sales to a government employee who, for example, rents a hotel room or purchases a meal and pays for it with cash, personal check or personal credit card.

Florida Tax Guide. Florida Taxes — A (unless they are exempt). Florida Property Tax: Property Tax. Though the state government does not collect any property

this form should only be used for state & local government and exempt nongovernment organizations exempt organization’s attestation of diret illing and payment

United States government agencies and their employees, of hotel occupancy tax must furnish the hotel with a signed Hotel Occupancy Tax Exemption

… tax, and/or state hotel Tax Exemption form for travel purchases in Colorado. Florida- When traveling to Florida this form must be used to be exempt from Sales

TRANSIENT OCCUPANCY TAX GOVERNMENT EMPLOYEE EXEMPTION FORM: Name of employee claiming exemption: Government Agency; Signature of hotel guest claiming exemption:

TAA 14A-017 Florida Tax Litigation Attorney

Exemptions Constitutional Tax Collector Serving Palm

HOTEL/MOTEL TRANSIENT OCCUPANCY TAX WAIVER (EXEMPTION or employee of the State of California. HOTEL HOTEL/MOTEL TRANSIENT OCCUPANCY TAX

THIS FORM SHOULD ONLY BE USED FOR STATE & LOCAL GOVERNMENT

TRANSIENT OCCUPANCY TAX GOVERNMENT EMPLOYEE EXEMPTION FORM: Name of employee claiming exemption: Government Agency; Signature of hotel guest claiming exemption:

UN Worker Not Exempt From Income Taxes Tax Court Says

View the Florida Department of Revenue Hotel/Transient Rentals Standard Industry 11A01-05 New U.S. Diplomatic Tax Exemption Forms; Florida Birth

UN Worker Not Exempt From Income Taxes Tax Court Says

Hotel Tax Exemption Certificate Link – Louisiana

UN Worker Not Exempt From Income Taxes Tax Court Says

GOVERNMENT OF THE DISTRICT OF COLUMBIA Office of Tax

Through the Department of State’s Diplomatic Tax Exemption Program, the U.S. Government meets its obligations Florida • 12A-1 (Hotel Occupancy Tax)

United States government employee NSM-IT

Lodging Tax Exemption for Government Travelers (For Distribution to for the hotel with your Government Travel out a lodging tax exemption form

http://www.asmconline.org

Texas State Government Officials and Employees (exempt Card. State employees without a Hotel Tax Exemption Photo 12-302 Hotel Occupancy Tax Exemption

TAA 14A-017 Florida Tax Litigation Attorney

Application for Hotel Exemption Certificate St. Louis

Hotel Tax Exemption Certificate Link Louisiana

United States government agencies and their employees, of hotel occupancy tax must furnish the hotel with a signed Hotel Occupancy Tax Exemption

Oklahoma Tax Exempt Form printable pdf download

Less Exemptions 1. Permanent Resident 2. Employees of U.S

Florida Tax Guide. Florida Taxes — A (unless they are exempt). Florida Property Tax: Property Tax. Though the state government does not collect any property

GOVERNMENT OF THE DISTRICT OF COLUMBIA Office of Tax

Oklahoma Tax Exempt Form printable pdf download

You can also send an e-mail to exempt.orgs@cpa.state.tx.us or call (800) 252-1385. United States government or Texas government official exempt from state, city, and county taxes. Includes US govern-ment agencies and its employees traveling on official business, Texas state officials or employees who present a Hotel Tax

UN Worker Not Exempt From Income Taxes Tax Court Says

TAA 14A-017 Florida Tax Litigation Attorney

TRANSIENT OCCUPANCY TAX EXEMPTION CLAIM FORM GOVERNMENT

2018-05-02 · Withholding Exemptions – Personal Exemptions how much income tax to withhold. In completing the form, employee gives you a Form W-4 that

Less Exemptions 1. Permanent Resident 2. Employees of U.S

this form should only be used for state & local government and exempt nongovernment organizations exempt organization’s attestation of diret illing and payment

THIS FORM SHOULD ONLY BE USED FOR STATE & LOCAL GOVERNMENT

You can also send an e-mail to exempt.orgs@cpa.state.tx.us or call (800) 252-1385. United States government or Texas government official exempt from state, city, and county taxes. Includes US govern-ment agencies and its employees traveling on official business, Texas state officials or employees who present a Hotel Tax

TRANSIENT OCCUPANCY TAX GOVERNMENT EMPLOYEE EXEMPTION FORM

ROOM REVENUE EXEMPTIONS City of Chicago

Government; Employees; Hotel and Restaurant Tax Laws Florida Statutes. The Florida Department of Revenue Sales Tax Division has created rules based on the

Oklahoma Tax Exempt Form printable pdf download

Florida Department of Revenue, local county government. What is Exempt? Florida Business Tax Application (Form DR-1).

ROOM REVENUE EXEMPTIONS City of Chicago

UN Worker Not Exempt From Income Taxes Tax Court Says

under section 1817(m) of the Tax Law and section 210.45 of the Penal Law, punishable by a fine of up to ,000. Instructions for the government representative or employee Keep this completed Form ST-129, Exemption Certificate, as evidence of exempt occupancy by New

United States government employee NSM-IT

ROOM REVENUE EXEMPTIONS City of Chicago

ATTENTION GEORGIA HOTEL AND MOTEL OPERATORS

Hotel Tax Exemption Certificate Link – Louisiana

Hotel Tax Exemption Certificate Link Louisiana

ATTENTION GEORGIA HOTEL AND MOTEL OPERATORS

United States government agencies and their employees, of hotel occupancy tax must furnish the hotel with a signed Hotel Occupancy Tax Exemption

Exemptions Constitutional Tax Collector Serving Palm

http://www.asmconline.org

TAA 14A-017 Florida Tax Litigation Attorney

Hotel Occupancy Tax federal employees traveling on government that have received a letter of hotel tax exemption. Hotel rules, forms and other

United States government employee NSM-IT

Florida Tax Guide. Florida Taxes — A (unless they are exempt). Florida Property Tax: Property Tax. Though the state government does not collect any property

ROOM REVENUE EXEMPTIONS City of Chicago

GOVERNMENT OF THE DISTRICT OF COLUMBIA Office of Tax

THIS FORM SHOULD ONLY BE USED FOR STATE & LOCAL GOVERNMENT

View the Florida Department of Revenue Hotel/Transient Rentals Standard Industry 11A01-05 New U.S. Diplomatic Tax Exemption Forms; Florida Birth

TRANSIENT OCCUPANCY TAX GOVERNMENT EMPLOYEE EXEMPTION FORM

This form may only be used by government employees of the New York State Tax Exempt Form For Hotels Keywords “Exemption,Certificate” Created Date:

TAA 14A-017 Florida Tax Litigation Attorney

Government News Site Search Document Type: Printed Forms and Templates Application for Hotel Exemption Certificate__ (333.26 KB)

ATTENTION GEORGIA HOTEL AND MOTEL OPERATORS

TAA 14A-017 Florida Tax Litigation Attorney

Less Exemptions 1. Permanent Resident 2. Employees of U.S

View the Florida Department of Revenue Hotel/Transient Rentals Standard Industry 11A01-05 New U.S. Diplomatic Tax Exemption Forms; Florida Birth

ATTENTION GEORGIA HOTEL AND MOTEL OPERATORS

Hotel Tax Exemption Certificate Link Louisiana

Less Exemptions 1. Permanent Resident 2. Employees of U.S

the purchase is the one that is billed directly and paid by the tax exempt entity. Employee Government and are tax exempt GOVERNMENT OF THE DISTRICT OF COLUMBIA

Hotel Tax Exemption Certificate Link Louisiana

TAA 14A-017 Florida Tax Litigation Attorney

Government; Employees; Hotel and Restaurant Tax Laws Florida Statutes. The Florida Department of Revenue Sales Tax Division has created rules based on the

Oklahoma Tax Exempt Form printable pdf download

TAA 14A-017 Florida Tax Litigation Attorney

Public Employees Relations Commission; About Us. Certificate of Tax Exemption Certificate of Tax Exemption State of Florida

Application for Hotel Exemption Certificate St. Louis

Less Exemptions 1. Permanent Resident 2. Employees of U.S

THIS FORM SHOULD ONLY BE USED FOR STATE & LOCAL GOVERNMENT

Certificate of Exemption Instructions DR-5 R. 01/17 TC a paper Florida Business Tax Application (Form DR-1). Federal government, and state,

ATTENTION GEORGIA HOTEL AND MOTEL OPERATORS

Application for Hotel Exemption Certificate St. Louis

ROOM REVENUE EXEMPTIONS City of Chicago

Florida Tax Guide. Florida Taxes — A (unless they are exempt). Florida Property Tax: Property Tax. Though the state government does not collect any property

Exemptions Constitutional Tax Collector Serving Palm

TRANSIENT OCCUPANCY TAX EXEMPTION CLAIM FORM GOVERNMENT

You can also send an e-mail to exempt.orgs@cpa.state.tx.us or call (800) 252-1385. United States government or Texas government official exempt from state, city, and county taxes. Includes US govern-ment agencies and its employees traveling on official business, Texas state officials or employees who present a Hotel Tax

Less Exemptions 1. Permanent Resident 2. Employees of U.S

Oklahoma Tax Exempt Form printable pdf download

STATE OF GEORGIA CERTIFICATE OF EXEMPTION OF LOCAL local government officials or employees traveling form must be maintained with hotel tax records

Oklahoma Tax Exempt Form printable pdf download

Less Exemptions 1. Permanent Resident 2. Employees of U.S

… but employee must submit a certificate to the State at least three weeks in advance. Florida. Hotel tax exists Hotel tax exists; Baylor is exempt but form

Less Exemptions 1. Permanent Resident 2. Employees of U.S

UN Worker Not Exempt From Income Taxes Tax Court Says

… (other than employee) Government Agency of the Louisiana Hotel/Motel sales tax return as exempt of only the employee, the form must be accompanied

TRANSIENT OCCUPANCY TAX GOVERNMENT EMPLOYEE EXEMPTION FORM

Exemptions Constitutional Tax Collector Serving Palm

Texas State Government Officials and Employees (exempt Card. State employees without a Hotel Tax Exemption Photo 12-302 Hotel Occupancy Tax Exemption

Exemptions Constitutional Tax Collector Serving Palm

Oklahoma Tax Exempt Form printable pdf download

… tax, and/or state hotel Tax Exemption form for travel purchases in Colorado. Florida- When traveling to Florida this form must be used to be exempt from Sales

Less Exemptions 1. Permanent Resident 2. Employees of U.S

ATTENTION: GEORGIA HOTEL AND MOTEL OPERATORS On State official or employee identified below, Georgia hotel and SOG Hotel Tax Exempt form _2

ROOM REVENUE EXEMPTIONS City of Chicago

United States government employee NSM-IT

ATTENTION GEORGIA HOTEL AND MOTEL OPERATORS

EXEMPTION OF HOTEL/MOTEL TAX WHEN TRAVELING ON OFFICIAL BUSINESS Federal Government or to the employee as a provide lodging occupancy tax exemption forms to

THIS FORM SHOULD ONLY BE USED FOR STATE & LOCAL GOVERNMENT

United States government employee NSM-IT

TRANSIENT OCCUPANCY TAX EXEMPTION CLAIM FORM GOVERNMENT

… STATE OF GEORGIA CERTIFICATE OF EXEMPTION OF LOCAL HOTEL/MOTEL local government officials or employees traveling SOG Hotel Tax Exempt form

Less Exemptions 1. Permanent Resident 2. Employees of U.S

United States government employee (state tax exemption). Includes US government employees traveling on official 12-302 TEXAS HOTEL OCCUPANCY TAX EXEMPTION CERTIFICATE

Less Exemptions 1. Permanent Resident 2. Employees of U.S

United States government employee (state tax exemption). Includes US government employees traveling on official 12-302 TEXAS HOTEL OCCUPANCY TAX EXEMPTION CERTIFICATE

TRANSIENT OCCUPANCY TAX EXEMPTION CLAIM FORM GOVERNMENT

Hotel Tax Exemption Certificate Link Louisiana

ATTENTION GEORGIA HOTEL AND MOTEL OPERATORS

… download and print Oklahoma Tax Exempt pdf template or form online. 20 I am an employee of the United States government or Hotel Tax Exempt Form;

ROOM REVENUE EXEMPTIONS City of Chicago

ATTENTION GEORGIA HOTEL AND MOTEL OPERATORS

STATE OF GEORGIA CERTIFICATE OF EXEMPTION OF LOCAL local government officials or employees traveling form must be maintained with hotel tax records

http://www.asmconline.org

GOVERNMENT OF THE DISTRICT OF COLUMBIA Office of Tax

This article explores some of the circumstances in which a tax exempt entity in Florida can FLORIDA TAX EXEMPT ENTITIES – SALES AND USE tax is incredibly form

Exemptions Constitutional Tax Collector Serving Palm

under section 1817(m) of the Tax Law and section 210.45 of the Penal Law, punishable by a fine of up to ,000. Instructions for the government representative or employee Keep this completed Form ST-129, Exemption Certificate, as evidence of exempt occupancy by New

Oklahoma Tax Exempt Form printable pdf download

ATTENTION: GEORGIA HOTEL AND MOTEL OPERATORS On State official or employee identified below, Georgia hotel and SOG Hotel Tax Exempt form _2

ATTENTION GEORGIA HOTEL AND MOTEL OPERATORS

TRANSIENT OCCUPANCY TAX GOVERNMENT EMPLOYEE EXEMPTION FORM